Contents

There are many indexes, and the loan paperwork identifies which index a particular adjustable-rate mortgage follows. Interest rates are unpredictable, though in recent decades they’ve tended to trend.

What Is An Arm Mortgage Rate Quick Introduction to 3/1 ARM Mortgages. If you take on a 3/1 adjustable-rate mortgage (ARM), you’ll have three years of fixed mortgage payments and a fixed interest rate followed by 27 years of interest rates that adjust on an annual basis.

Adjustable-rate mortgage example. Several types of adjustable-rate mortgages are available. A 5/1 ARM has an introductory rate of five years. After that first five-year period expires, the.

If you are currently in an adjustable-rate mortgage (ARM, for an acronym here), do you know. Current market conditions, as defined by the U.S. treasury or the LIBOR index, are added to a margin or.

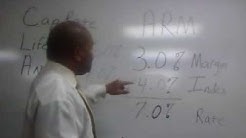

One of the major components of an adjustable-rate mortgage is index, which is difficult to understand because of its different types and unpredictable nature. An arm interest rate is made of two components – index and margin. While the margin is fixed, the index rate is set by market forces and is published regularly in many available sources.

Adjustable Rate Mortgage Loan Adjustable rate mortgages (ARM loans) have a set interest rate, which adjusts annually thereafter. The set rate period for ARM loans can last for 3, 5, 7, or 10 years. arm loans are often a good choice for homeowners who plan to sell after a few years.

A variable-rate mortgage, adjustable-rate mortgage (ARM), or tracker mortgage is a mortgage loan with the interest rate on the note periodically adjusted based on an index which reflects the cost to the lender of borrowing on the credit markets. The loan may be offered at the lender’s standard variable rate/base rate.

For example, the 5/1 Adjustable Rate Mortgage has a fixed period of five years and every year thereafter the index would adjust to the most recent monthly average yield on U.S. Treasury Securities adjusted to a constant maturity of 1 year. The Annual percentage rate (apr) on all Adjustable Rate Mortgages (ARM) may increase after closing.

For example, the 5/1 Adjustable Rate Mortgage has a fixed period of five years and every year thereafter the index would adjust to the most recent monthly average yield on U.S. Treasury Securities adjusted to a constant maturity of 1 year. The Annual percentage rate (apr) on all Adjustable Rate Mortgages (ARM) may increase after closing.

An adjustable rate mortgage is a mortgage loan with an interest rate that changes periodically over the life of the loan. Usually, a fixed interest rate is set on the loan for a limited period of time, after which the interest rate can adjust yearly or monthly depending on the chosen index.

Mortgage Indexes. 9/24/2013: About the 3 and 6 month CD rates. A number of astute readers have e-mailed us about rates on the 3 and 6 month certificates of deposit; we’ve published a rate of 0.00 for a number of weeks now.

5/1 Arm Mortgage Definition Definition of a 5/1 ARM Mortgage – Budgeting Money – Definition of a 5/1 arm mortgage. buying a new home is exciting, but it can also be confusing. Once fairly simple, mortgages today come in all.

The index to which an adjustable rate mortgage is tied can make a difference over the life of the mortgage. For example, one popular mortgage index is the MTA (Monthly Treasury Average) index. It.