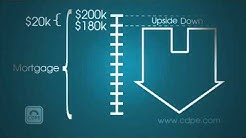

The Definition of Upside-Down Mortgage. As a result, homeowners who put little down or bought homes in areas worst affected by the crisis found themselves in an upside-down mortgage–where a home’s value is less than the amount owed–creating a negative equity situation for millions of households almost overnight.

Your mortgage, your pension, your savings, your investments. The prospects for all these have changed significantly as the financial world appears to be turning upside down. Interest rates on many.

Then her world gets turned upside down when an old lover names her as an accomplice to a crime made ten years earlier. Chapman was convicted of transporting a suitcase full of drug money that she had.

An upside-down mortgage is simply a mortgage in which the owner owes more than the house is worth. If you can afford the monthly mortgage payments and don’t want to move, being upside down may not have an immediate effect.

When Will My First Mortgage Payment Be Due Your Debt-To-Income Ratio The first. you can mortgage a new home. But what sort of mortgage can you afford? For example, if your monthly gross income is $4,000, you multiply this number by 0.43. $1.Can You Get A Mortgage Without A Job · But don’t worry, you aren’t helpless. It’s possible to get loans and credit without having an established credit history. We’ll teach you how to get a loan with no credit today. It’ll require a little bit of work in many cases, but it’s well worth the effort.

ARE YOU IN AN UPSIDEDOWN MORTGAGE? In a 2007 newsletter, I made the claim that in 2008 we would see real estate values drop by 40%. My colleagues.

A friend of mine is upside-down on her mortgage.she has this brilliant idea to buy a new home, and then foreclose on her old one after she’s already in the new home. I know this is a bad idea, but I don’t know how to tell her WHY its a bad idea..can you help?

Employment History Letter For Mortgage You can apply to get the employment history of someone who’s died if you’re legally entitled to claim damages on behalf of their estate: as part of a claim for personal injury or a fatal accident;

An upside-down mortgage is simply a mortgage in which the owner owes more than the house is worth. If you can afford the monthly mortgage payments and don’t want to move, being upside down may not have an immediate effect. However, it will take longer to build equity in your home, which will affect your ability to refinance or sell your home and make a profit. Fluctuation in home values. Volatility in neighborhood home values is the biggest cause of upside-down mortgage situations.

An upside-down mortgage is simply a mortgage in which the owner owes more than the house is worth. If you can afford the monthly mortgage payments and don’t want to move, being upside down may not have an immediate effect. However, it will take longer to build equity in your home, which will affect your ability to refinance or sell your home and make a profit. Fluctuation in home values. Volatility in neighborhood home values is the biggest cause of upside-down mortgage situations.

An upside down mortgage is where an owner of a house owes more on the house than what the house is worth and is in negative equity. For example, if an owner owes $200,000 on a house, but the house value if worth only $180,000 than the owner has an upside down mortgage.